The art market in the United States has undergone significant evolution over the years, influenced by various factors, including economic trends, cultural movements, and the innovative strategies of galleries. As collectors seek new avenues for investment, art has emerged as a viable and often lucrative option. This article explores how galleries play a crucial role in shaping the U.S. art market, focusing on their impact on investment trends, artist promotion, and market accessibility. A notable example within this landscape is the availability of Shepard Fairey prints for sale, which highlights how contemporary artists and galleries influence investment opportunities.

The Role of Galleries in Market Formation

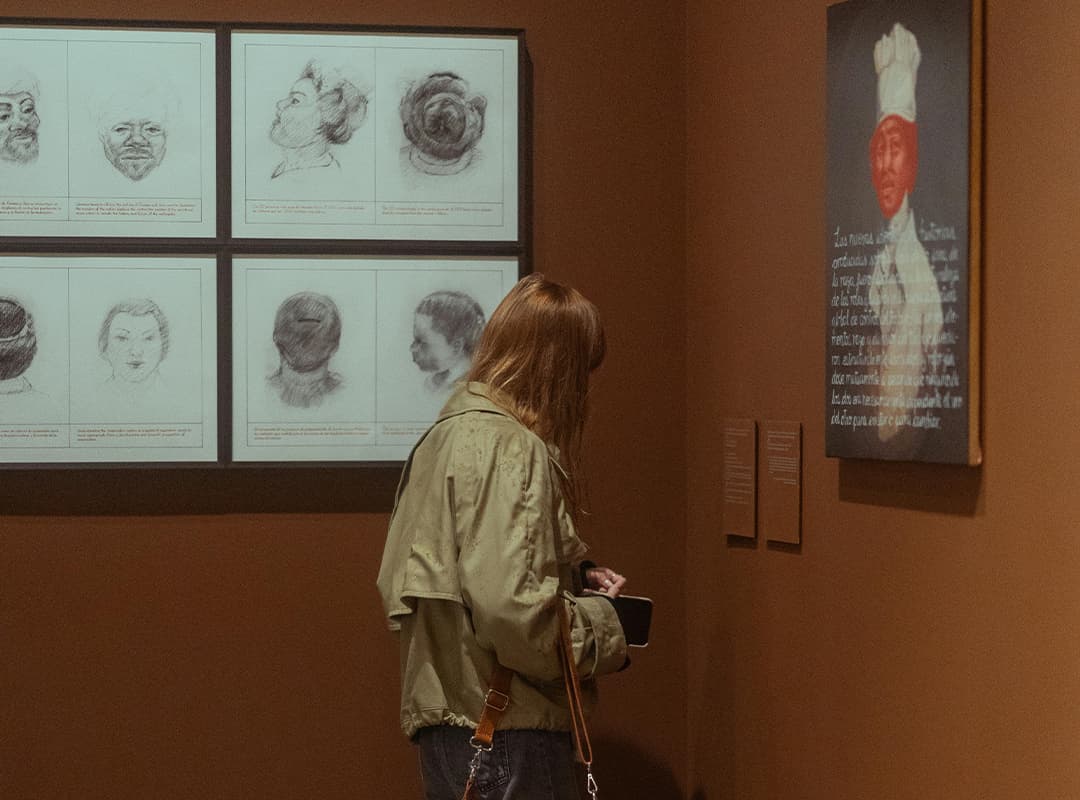

Galleries serve as the primary platform for artists to showcase their work and engage with collectors. By curating exhibitions and promoting specific artists, galleries help shape the art market by creating demand for certain styles, genres, and mediums.

Through strategic marketing and public relations, galleries can elevate an artist’s profile, increasing the perceived value of their work. This process not only benefits individual artists but also contributes to the overall health of the art market, creating a ripple effect that influences prices and trends.

Promoting Emerging and Established Artists

One of the critical functions of galleries is to promote both emerging and established artists. By providing a platform for artists to showcase their work, galleries help establish their reputations and cultivate a following among collectors.

In recent years, galleries have increasingly focused on diversifying their rosters to include a wide range of voices and perspectives. This shift has not only enriched the art market but has also opened up new investment opportunities for collectors looking to support underrepresented artists.

For example, Shepard Fairey, known for his iconic street art and social commentary, has gained significant attention through gallery exhibitions and the availability of prints for sale. These prints often serve as accessible entry points for new collectors and art enthusiasts looking to invest in contemporary art.

Art as an Alternative Investment

As traditional investment avenues become more volatile, many investors are turning to art as an alternative asset class. The art market has demonstrated resilience, with certain artworks appreciating significantly over time.

Galleries play a vital role in facilitating this investment by providing valuable information about artists, market trends, and artwork provenance. They also offer collectors insights into the potential future value of specific pieces, helping investors make informed decisions.

In particular, the availability of prints, such as Shepard Fairey prints for sale, allows collectors to invest in artworks at a more accessible price point, often making it easier for new collectors to enter the market. This approach democratizes art investment, allowing a broader audience to participate in the art economy.

Building Relationships and Community

The relationship between galleries and collectors extends beyond transactions; it is built on trust and community. Galleries often host events, such as artist talks, exhibitions, and openings, which foster connections between collectors and artists.

This community-building aspect enhances the overall experience of art collecting, as collectors can engage directly with artists and gain a deeper understanding of their work. These relationships often lead to increased confidence in investing, as collectors feel more connected to the art they purchase.

Navigating Market Trends and Economic Influences

Galleries are instrumental in navigating the complexities of the art market, especially during times of economic uncertainty. They provide insights into market trends and shifts in consumer behavior, allowing collectors to adapt their investment strategies accordingly.

During economic downturns, for instance, galleries may adjust their pricing strategies or focus on promoting more affordable works to cater to changing buyer demographics. By staying attuned to these trends, galleries help collectors make strategic decisions about their investments.

Digital Transformation and Online Sales

The rise of digital platforms has revolutionized the art market, providing new avenues for galleries to reach collectors. Online sales have become increasingly popular, allowing galleries to showcase their inventory to a global audience.

This digital transformation has expanded access to art, making it easier for collectors to discover and purchase works from the comfort of their homes. The availability of prints, such as Shepard Fairey prints for sale, through online platforms exemplifies how galleries can effectively reach new audiences and facilitate investment opportunities.

As galleries continue to play a pivotal role in shaping the U.S. art market, their influence on investment trends, artist promotion, and community building cannot be overstated. By fostering relationships between artists and collectors, galleries create a vibrant ecosystem that supports the growth of the art market.

The emergence of art as a viable investment option is reshaping the landscape of collecting, with galleries at the forefront of this transformation. As they navigate the complexities of the market and adapt to changing consumer behaviors, galleries will continue to provide valuable insights and opportunities for both new and seasoned collectors.

In this evolving landscape, investing in art offers not only financial potential but also the chance to support artists and contribute to the cultural dialogue. With the continued availability of accessible artworks, such as Shepard Fairey prints for sale, the future of art investment looks promising, inviting a new generation of collectors to engage with the vibrant world of contemporary art.